The iGaming companies operate in a very competitive industry, where the difference between keeping or losing a customer is made by smart, fast, and flexible payment methods. This has led the iGaming market to break new ground in the field of advanced payment solutions, carefully observing and anticipating the trends towards shaping the future of payments.

Mobile gaming has resulted in the dismissal of some environmental obstacles to iGaming services, users no longer needing to make bets in public, being able to do so from the privacy of their own homes. And even though there have been concerns about the easy access, it surely has contributed to the variety of games available, making it more exciting and entertaining for those that play them.

Mobile Gaming

Smartphones have turned into one of the most popular options for people to go online and many prefer using their smartphones to gamble, instead of visiting land-based casinos. With games being available 24/7 online, it makes perfect sense that more individuals are forsaking the brick-and-mortar casinos for online gaming. Whether it’s from the comfort of their home or on the move, many are accessing their favorite iGaming websites for mobile bonuses and entertainment, such as Casinobonusca.com.

Based on recent reports, only in 2019 mobile games have earned up to $68.5 billion, with the most revenue coming from Android devices 35.8% and 48.9% from games on iOS devices. In the course of the first half of 2019, all games on Android and iOS met 19.4 billion downloads.

Mobile gaming statistics clearly show that above 50% of the global video game income is generated from mobile gaming and is the most rapidly growing source of profit in the video game branch. This tremendous growth has been made available with many factors, such as the increasing purchase of smartphones and tablets as well as the 4G/5G internet connection to most of the global population.

The technological development has also participated in driving the mobile gaming market further, providing the users with improved gaming experience such as augmented and virtual reality, along with realistic visuals, sensor technology, and real-time data. Considering the industry trends, it is abundantly clear that the phenomenal growth of mobile gaming is not decelerating in the foreseeable future.

The mobile payments’ development

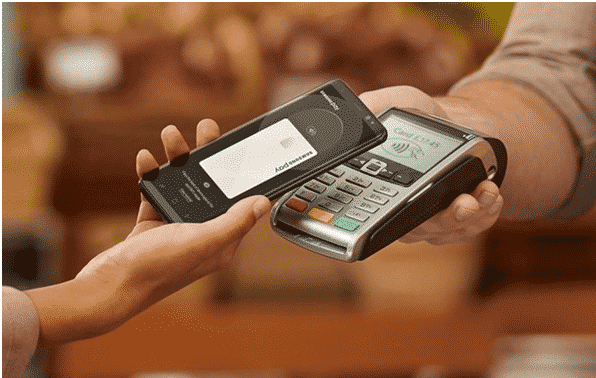

Alongside the rise of smartphones has been the growth of mobile payments. A significant part of the population prefers to utilize mobile payments to more conventional forms of payment like credit cards or cash. The industry is constantly rising, being estimated that the mobile payment market shall grow at a 33% annual rate and that by the year 2026 will finally reach the $457 billion mark. It is an incredible accomplishment for a sector that didn’t exist 15 years ago.

Mobile banking has changed the way we make payments, not only is it more comfortable (not needing to carry around cards or cash), but also more secure. It was in 2006 that PayPal initiated its mobile service, leading to mobile wallet development, which stores the card information on the device and enables the users to make payments over a smartphone app. There are numerous different types of mobile payments and below are some of the most popular and secure ones on the market:

- Cloud-based: The payout is made through an internet-based platform known as “The Cloud” and allows payment gateways to be made over the internet. The Cloud-based payments don’t require a physical device;

- Quick Response: QR payments are made via QR codes. The one thing necessary for the user is to scan a code using the smartphone’s camera;

- Pay Per SMS: This payment form requires the consumer to enter the recipient’s phone number and the amount to be sent. It is one of the simplest methods to place a mobile remuneration;

- Near Field Communication: This technology allows two NFC enabled devices to connect through communication protocols. The method is also known to be very secure;

- Near Sound Data Transfer: The NSDT is a sound-based mobile transaction technology that requires a mobile generated electronic signature.

The utilization of mobile payments contributes to the banking infrastructure. Mobile wallets help the areas where the banks can’t be reached or banking itself isn’t attainable. They also help diminish the financial scam, being secured with biometric systems like Face ID or fingerprint scanner. The convenience of faster transaction time also adds up to the long list of advantages.

Mobile Payments and iGaming

As the expenses on the online iGaming market are moving upward, so is the number of persons playing on mobile, as well as mobile payments for iGaming sites. The simplicity and security of mobile payouts is a great attraction for customers playing on gaming platforms and with the congestion of the online marketplace, it seems only logical why a growing number of websites want to get on-board with the service. For that reason, players have now a range of options in regard to paying on mobile sites, including Apple Pay. Recently, some gambling websites have provided their customers with cryptocurrency payments, which is believed to be more secure. For mobile casinos to keep up with the times and continue to engage new players, they need to constantly utilize the best technology, security, and payout methods.

Into the future

In the world of payments, technology is rapidly evolving, so it is imperative to keep a close eye on trends. Mobile payments for mobile casinos are likely to expand in options for their users. With the purpose of offering the players the top experience on the market, more websites will incorporate this technology into their payout methods. Consumers will be less likely to look the other way to an outdated experience caused by older tech and the friction created by outdated systems shall play an even more critical part in customer engagement in 2020. If we’re lucky, it is possible that in the future, as the rise of mobile payment usage grows, we will no longer need physical cards.